Unified Payments Interface (UPI) is an instant payment system developed by the National Payments Corporation of India (NPCI), an RBI-regulated entity. It is built over the IMPS (Immediate Payment Service) infrastructure and allows you to instantly transfer money between any two bank accounts.

UPI ID (also called Virtual Payment Address or VPA) is a unique ID for using UPI. The UPI ID can be created by registering with one of the UPI-enabled mobile applications (App) using your bank account details.

UPI as a payment mechanism is available for all public issues for which Red Herring Prospectus is filed after January 01, 2019.

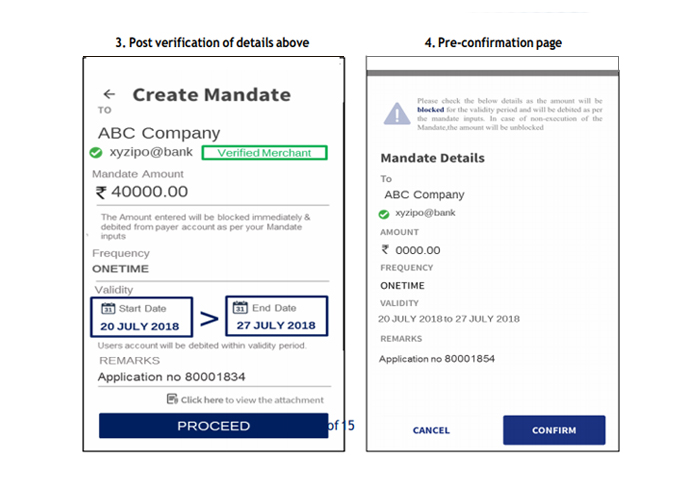

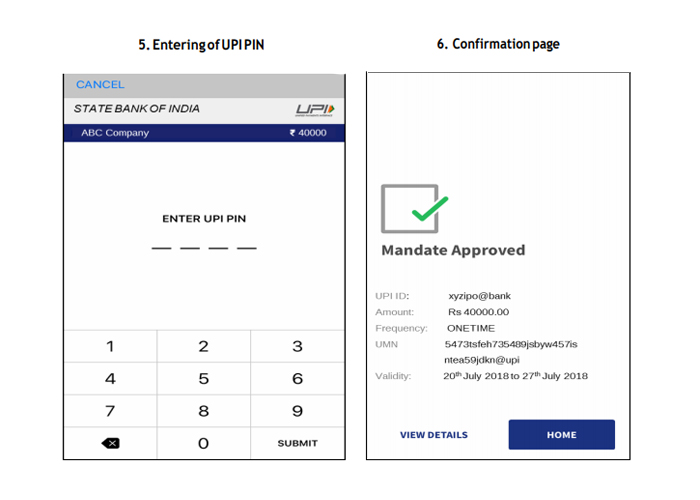

The public issue application using UPI is a step towards digitizing the traditional offline processes by moving them online. To apply, you need to create a UPI ID and PIN using any UPI-enabled mobile application. This UPI ID is used to block funds and make payments during the public issue process. Once you place your bid, you can approve the request to block the necessary funds by entering your UPI PIN in the app. The funds will be blocked and automatically remitted to the Escrow Bank in the event of an allotment. Using UPI in the public issue process offers greater convenience and ease of use and reduces the listing time for public issues.

UPI as Part of Blocking

UPI as part of payment for shares post-allocation process

The following graphical illustration provides an overview of this process:

No, application forms using UPI as a payment method can only be submitted through a Syndicate Member, a Registered Stock Broker, a Registrar and Transfer Agent, or a Depository Participant (collectively referred to as ‘Intermediaries’).

The limit for IPO application is 2 Lakhs per transaction on UPI.

No. Only retail individual investors are allowed to use UPI for payment in public issues. Qualified Institutional Buyers and High Net-worth Individuals shall continue to apply as per the existing process.

Yes. In Phase I, all existing channels will remain available for retail investors. However, from Phase II onwards, the option to submit non-UPI applications through intermediaries will be discontinued. Starting in Phase II, investors submitting applications via intermediaries must use UPI as the payment method. Other channels will remain available, such as submitting applications directly with SCSBs (Self-Certified Syndicate Banks) or using 3-in-1 accounts..

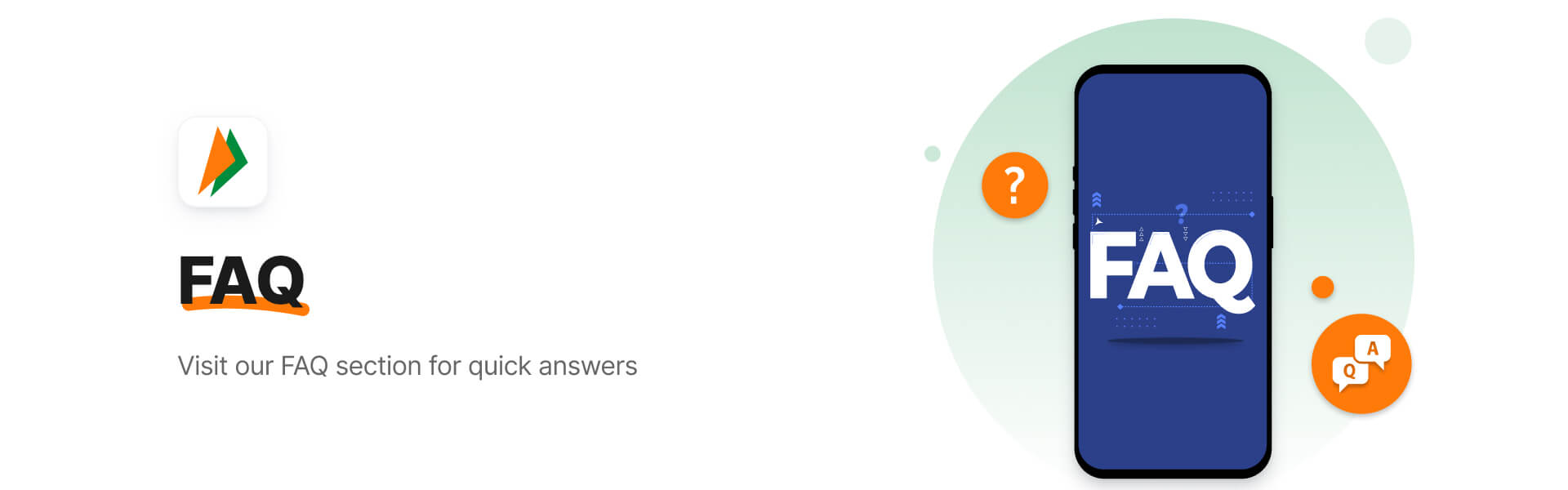

Public issues using UPI may be initiated through any of the intermediaries. The UPI ID can be given to the intermediary with whom the application form is being submitted. You shall receive all requests to block the bid amounts on this UPI ID / App. You would need to enter your UPI PIN to accept the mandate request for blocking the amount.

The application form for an IPO now includes a field for entering your UPI ID as a payment mechanism. Further, you can contact any of the Intermediaries, who can guide you through the process in detail.

No, currently, bidding for a public issue directly through the UPI application is not available. The UPI application can only be used for blocking and payment of funds in public issues at this time.

If your bank does not offer UPI services for public issues, you can still apply for fund blocking by using your bank account. Depending on the application phase (I, II, or III), submit your application through the designated Self-Certified Syndicate Bank (SCSB) or intermediary to ensure funds are appropriately blocked.

No. In order to use UPI for payment, the bank where you hold an account linked to your UPI ID also needs to be eligible to act as an Issuer Bank in the public issue process. The list of such banks is available on the website of SEBI at https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=40

No. You must apply by providing your UPI ID only, on which the request for blocking the amount shall be received.

There is no restriction for you on the number of public issues using the same UPI ID.

No. Applications made by retail investors using a third-party UPI ID or by any category of investors using a third-party bank account will not be considered for allocation.

SEBI Circular only specifies that applications made by retail investors using third-party UPI ID or by any category of investors using a third-party bank account are liable for rejection. SEBI has imposed no specific restriction on the use of bank accounts by second / third / joint account holder.

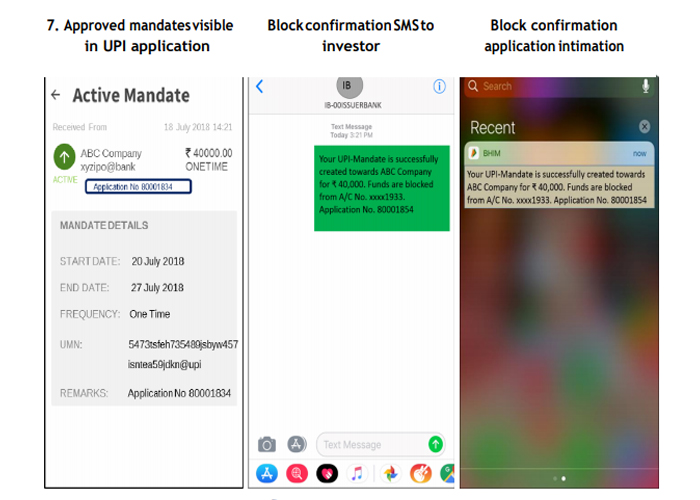

Yes. Once the bid details are uploaded on the stock exchange platform, the stock exchange will send you an SMS regarding the bid of your application on an end-of-day basis. For the last day of bidding, the SMS may be sent out the next working day.

An investor should first approach the intermediary to whom the application was submitted. For complaints regarding the blocking or unblocking of funds, the investor may contact the relevant bank. For issues related to the non-allotment of shares, the investor should approach the registrar for the issue. If these responses are unsatisfactory, the investor may then escalate the complaint to the stock exchange. Should the investor remain dissatisfied after these steps, they may submit a complaint to SEBI through the SCORES portal at http://scores.gov.in/.

In such a case, you may approach the same intermediary with whom the application form was submitted to re-initiate the process. You may also like to check whether the UPI ID recorded is correct.

In such a case, the transaction will not be initiated or may be initiated to the wrong UPI ID. The transaction needs to be re-initiated as a new request after the correct UPI ID is submitted.

In case the request is erroneously declined by you, the transaction will be declined and you will have to initiate a fresh request. The transaction can be re-initiated by approaching the intermediary with whom the application form was submitted.

The transaction will be declined with ‘Wrong UPI PIN,’ and you will have to re-initiate it. You can re-initiate the transaction by approaching the same intermediary with whom the application form was submitted.

In case of a technical decline, the transaction can be re-initiated by approaching the intermediary with whom the application form was submitted.

Yes. As per the indicative activity-wise timeline prescribed in the SEBI Circular dated November 01, 2018, in Phase I, all block requests that have not been acted upon by 12:00 p.m. on T+2 day, i.e. two days after the issue's closure will lapse. In Phase II, all block/collect requests that have not been acted upon by 12:00 p.m. on T+1 day, i.e. one day after the issue's closure, will lapse.

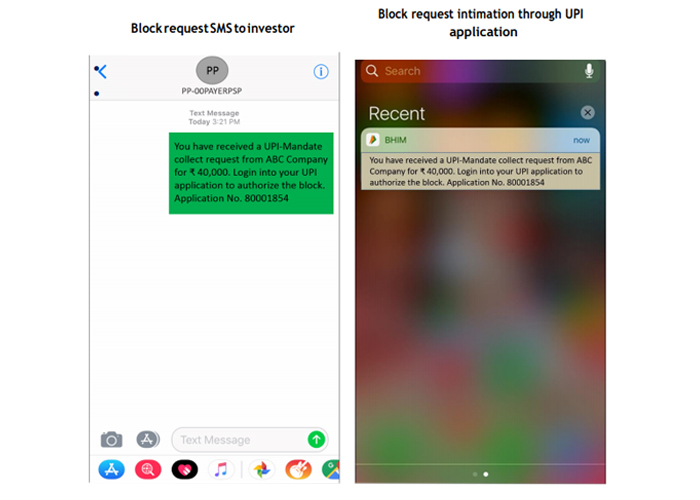

To ensure that the block request is not fraudulent, check if the UPI ID is marked as a "Verified Merchant." Look for the "Verified Merchant" tag when you receive the request to block the amount you have bid. This request will appear as a collect request on your UPI-enabled app. Additionally, verify the details provided in the request, including your Bid-cum Application number, bid amount, and other related details, which will be enclosed as an attachment in the block request.

The amount will be blocked until the finalization of allotment, after which the amount equivalent to allotted shares will be debited, and the balance amount (in case of partial allotment) will be unblocked.

In such a case, you can raise a complaint with the bank with the respective Unique Mandate Number provided for the block request.

The status of the active requests can be viewed in the Mandate section of your UPI app.

The default account is independent of the block request. The execution will happen against the same account for which the UPI PIN was entered by you at the time of accepting the block request.

De-registration will not be available from the application until the active requests are revoked / executed.

Transaction will be declined in case the account has insufficient funds.

While the UPI framework supports both mandate creation and execution on a holiday, the uploading of bids in a public issue happens only on working days, as defined in the SEBI Circular dated November 01, 2018. Accordingly, you may not receive a mandate request on a holiday. However, you can act upon mandate requests that are pending in your app on a holiday.

Yes. The same UPI PIN can be used to accept a block request for a public issue application.

UPI PIN is required only once at the time of confirmation of the request.

In such a case, the customer should reach out to their bank using the Unique Mandate Number (UMN) for the respective block request.

Execution of the block request is independent of the UPI ID and will be executed against the same account which was used at the time of creating the request.

No, the values in the block request cannot be modified. Any modification to the bid details, including the amount, has to be undertaken by approaching the intermediary with whom the application form was submitted. Upon the intermediary's modification of the bid amount, you will receive a fresh block request with a revised amount, which needs to be authorised again by entering your UPI PIN.

In Phase I, all modification requests initiated within the prescribed time can be acted upon by 12:00 p.m. on T+2 day, two days after the issue's closure. In Phase II, all modification requests initiated within the prescribed time can be acted upon by 12:00 p.m. on T+1 day, one day after the issue's closure.

In such a case, you need to initiate a fresh modification request. The transaction can be re-initiated by approaching the intermediary with whom the application form was submitted.

Yes, the customer will receive a notification on the mobile application as well as an SMS for authorising the modification request.

Post the expiry time of the request / mandate, the modification request would lapse and the execution will take place based on the earlier approved request / mandate which is active.

Once the successful modification is done, a confirmation shall be given by the mobile application.

The execution of the mandate is independent of the said change and will be executed against the same account that was linked at the time of creating the mandate, irrespective of the fact that the UPI ID was changed at a later stage.

As per the extant legal framework, retail individual investors can withdraw bids till the closure date. During the bidding period, you may approach the same intermediary with whom the application form was submitted for bid withdrawal.

Revoking a block request refers to the cancellation of a previously submitted block request, typically following the cancellation of an IPO bid.

A mandate request once created can be revoked till closure of the issue. The revoke can be initiated through the intermediary with whom the application was submitted.

In such a case, you would need to re-initiate the revoke request. Such re-initiation can be done through the intermediary with whom the application was submitted.

Once the revoke request is submitted successfully, the mobile application will provide a success notification.

Yes, you will need the UPI PIN to revoke the request.

On revoking the mandate request, the bid amount will be immediately unblocked in your bank account.

The money in your account will be unblocked if the allotted shares are less than the bid quantity or if a block request is revoked.

In case you do not get any share allotment, the amount blocked in your account will be unblocked.

In case of part allocation, money will be debited for the allocation value, and the residual amount will be unblocked / reinstated in your account.

In case the shares have not been allotted to you and money is not unblocked / reinstated in your account, you may raise a complaint through the UPI App or approach your bank / RTA / the intermediary with whom the application was submitted.

In case the shares have not been allotted and money is debited from your account, you may file a complaint with your application details, either from the UPI App or by approaching your bank / RTA / the intermediary with whom the application was submitted.

Allotment of the shares will be done according to the timelines prescribed in SEBI Circular dated November 01, 2018, available at https://www.sebi.gov.in/legal/circulars/nov2018/streamlining-the-process-of-public-issue-of-equity-shares-andconvertibles_40923.html.

Under the UPI framework, you will be notified when funds are debited from your account. However, as per the extant process/es, the share allotment process shall be communicated separately.

Your money shall be unblocked / reinstated to your account with the expiry of the mandate period in case shares are not allotted to you.

In case an amount more than the allotment is debited, you may raise a complaint from the UPI App or bring the issue to the knowledge of your bank through any other mode against the Unique Mandate Number.

The mandate's execution is independent of the default account and will be executed against the same account that was linked when the mandate was created.

The execution of the mandate request is independent of the UPI ID and will be executed against the same account that was linked when the mandate was created.

SEBI circular only specifies that applications made by retail investors using third-party UPI ID or by any category of investors using a third-party bank account are liable for rejection.

Further, the question of whether UPI in the ASBA facility should be extended to Karta/HUF and Minor account holders doesn't fall within SEBI's regulatory purview. SEBI has not restricted any retail investor from accessing UPI in the ASBA facility based on the mode of operation of the investor's account.

While some banks allow the creation of UPI IDs for Karta/HUF and minor accounts, it is within the bank's discretion to decide whether these account holders will be allowed to create the UPI ID. However, SEBI has facilitated the submission of IPO applications, including those from Karta/HUF and Minor accounts, directly to the ASBA banks.

You may refer to the SEBI circular no. SEBI/HO/CFD/DIL2/CIR/P/2018/138 dated November 01, 2018 available on SEBI website at www.sebi.gov.in under the categories “Legal” and “Circulars” for more information, https://www.sebi.gov.in/legal/circulars/nov2018/streamlining-the-process-of-public-issue-of-equity-shares-andconvertibles_40923.html.